Is There Vat On Parking Charges Uk . Vat of parking fines was unclear till 2013. while vat on car parking does have its drawbacks, it’s important to understand that vat is a tax that contributes to government revenue and helps fund. Where there is no fee for parking in a private park, there is no supply for vat purposes. when is vat on the parking charged? The standard rate of vat increased to 20% on 4 january 2011. there is vat on some parking. the standard vat rate is 20% vat rates for goods and services. Later the court clarified the rules as follows: if a business charges for parking, whether it’s a car park, garage, or any other type of parking facility, they may be required to charge vat on top of the parking. excess charges for parking are generally subject to vat at the standard rate of 20% unless they are eligible for zero rating or exemption. if the park is public, there will be no vat on any parking fee.

from www.tide.co

Where there is no fee for parking in a private park, there is no supply for vat purposes. Vat of parking fines was unclear till 2013. there is vat on some parking. when is vat on the parking charged? if the park is public, there will be no vat on any parking fee. The standard rate of vat increased to 20% on 4 january 2011. Later the court clarified the rules as follows: excess charges for parking are generally subject to vat at the standard rate of 20% unless they are eligible for zero rating or exemption. the standard vat rate is 20% vat rates for goods and services. while vat on car parking does have its drawbacks, it’s important to understand that vat is a tax that contributes to government revenue and helps fund.

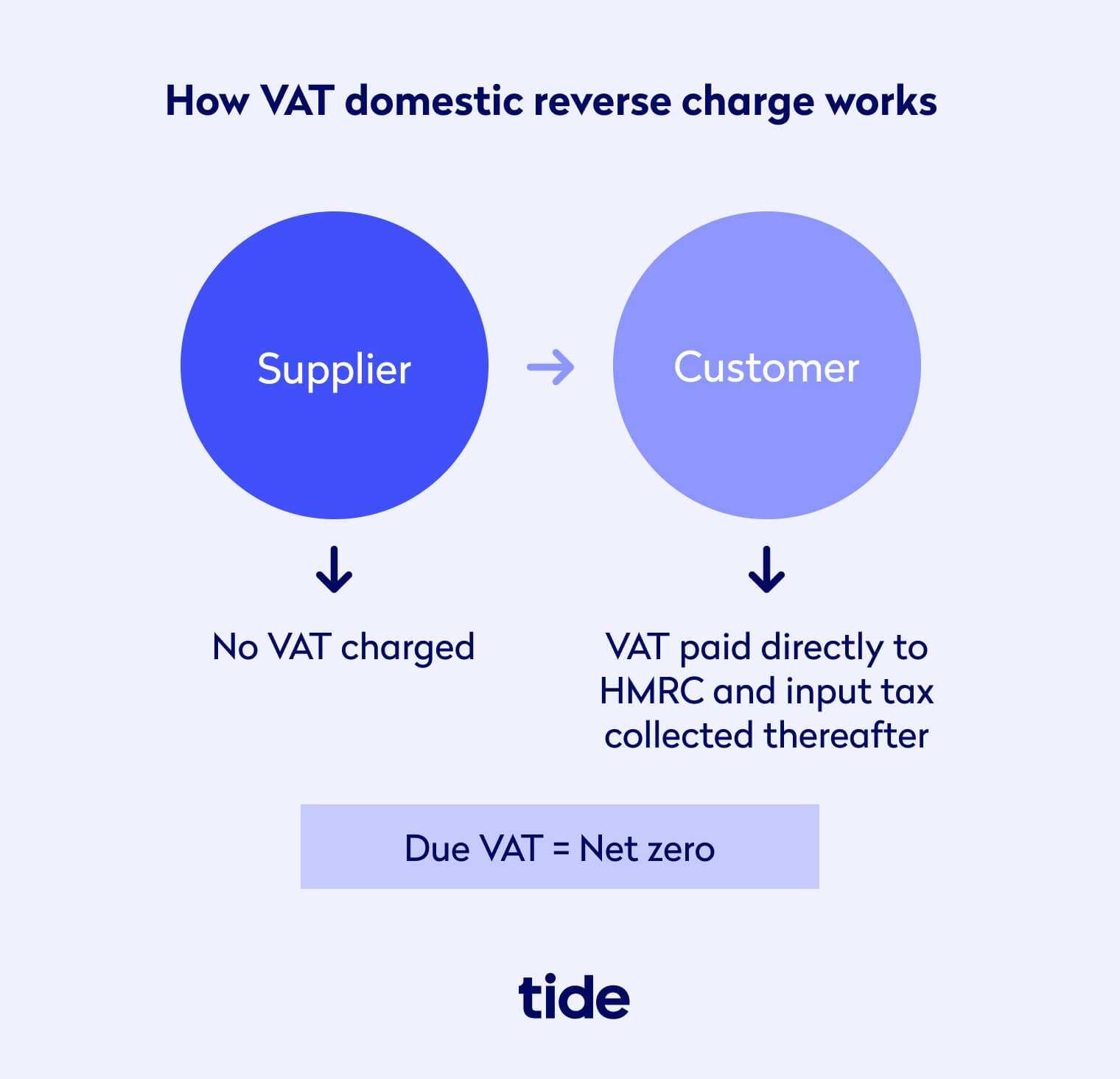

A guide to domestic VAT reverse charges Tide Business

Is There Vat On Parking Charges Uk Later the court clarified the rules as follows: excess charges for parking are generally subject to vat at the standard rate of 20% unless they are eligible for zero rating or exemption. Later the court clarified the rules as follows: while vat on car parking does have its drawbacks, it’s important to understand that vat is a tax that contributes to government revenue and helps fund. Vat of parking fines was unclear till 2013. there is vat on some parking. if a business charges for parking, whether it’s a car park, garage, or any other type of parking facility, they may be required to charge vat on top of the parking. the standard vat rate is 20% vat rates for goods and services. The standard rate of vat increased to 20% on 4 january 2011. Where there is no fee for parking in a private park, there is no supply for vat purposes. if the park is public, there will be no vat on any parking fee. when is vat on the parking charged?

From www.leasingoptions.co.uk

What are Parking Charge Notices? Leasing Options Is There Vat On Parking Charges Uk The standard rate of vat increased to 20% on 4 january 2011. if the park is public, there will be no vat on any parking fee. Where there is no fee for parking in a private park, there is no supply for vat purposes. excess charges for parking are generally subject to vat at the standard rate of. Is There Vat On Parking Charges Uk.

From www.rousepartners.co.uk

Construction VAT Reverse Charge What are the new rules? Rouse Is There Vat On Parking Charges Uk excess charges for parking are generally subject to vat at the standard rate of 20% unless they are eligible for zero rating or exemption. there is vat on some parking. Later the court clarified the rules as follows: when is vat on the parking charged? Where there is no fee for parking in a private park, there. Is There Vat On Parking Charges Uk.

From accotax.co.uk

VAT on Car Parking A Comprehensive Guide Accotax Is There Vat On Parking Charges Uk Where there is no fee for parking in a private park, there is no supply for vat purposes. while vat on car parking does have its drawbacks, it’s important to understand that vat is a tax that contributes to government revenue and helps fund. if the park is public, there will be no vat on any parking fee.. Is There Vat On Parking Charges Uk.

From smallbusinessowneradvice.co.uk

Is There VAT on Parking? (+ Charges, Fines, Exempt, ZeroRated) Is There Vat On Parking Charges Uk the standard vat rate is 20% vat rates for goods and services. excess charges for parking are generally subject to vat at the standard rate of 20% unless they are eligible for zero rating or exemption. The standard rate of vat increased to 20% on 4 january 2011. if the park is public, there will be no. Is There Vat On Parking Charges Uk.

From www.solihullupdates.com

Revealed the parking charge changes planned in Solihull Solihull Updates Is There Vat On Parking Charges Uk if the park is public, there will be no vat on any parking fee. Where there is no fee for parking in a private park, there is no supply for vat purposes. the standard vat rate is 20% vat rates for goods and services. when is vat on the parking charged? The standard rate of vat increased. Is There Vat On Parking Charges Uk.

From mungfali.com

Reverse Charge VAT Flowchart Is There Vat On Parking Charges Uk when is vat on the parking charged? Where there is no fee for parking in a private park, there is no supply for vat purposes. there is vat on some parking. The standard rate of vat increased to 20% on 4 january 2011. while vat on car parking does have its drawbacks, it’s important to understand that. Is There Vat On Parking Charges Uk.

From ukcarhub.com

Is There Vat On Car Parking? Exploring Values 2024 Updated Is There Vat On Parking Charges Uk if a business charges for parking, whether it’s a car park, garage, or any other type of parking facility, they may be required to charge vat on top of the parking. Where there is no fee for parking in a private park, there is no supply for vat purposes. while vat on car parking does have its drawbacks,. Is There Vat On Parking Charges Uk.

From www.quaderno.io

The Ultimate Guide to EU VAT for Digital Taxes Is There Vat On Parking Charges Uk if the park is public, there will be no vat on any parking fee. Where there is no fee for parking in a private park, there is no supply for vat purposes. Vat of parking fines was unclear till 2013. Later the court clarified the rules as follows: if a business charges for parking, whether it’s a car. Is There Vat On Parking Charges Uk.

From www.bbc.com

Parking charges could make £1bn for councils, study says BBC News Is There Vat On Parking Charges Uk if the park is public, there will be no vat on any parking fee. while vat on car parking does have its drawbacks, it’s important to understand that vat is a tax that contributes to government revenue and helps fund. if a business charges for parking, whether it’s a car park, garage, or any other type of. Is There Vat On Parking Charges Uk.

From www.legendfinancial.co.uk

VAT Exemptions When not to charge VAT Legend Financial Is There Vat On Parking Charges Uk excess charges for parking are generally subject to vat at the standard rate of 20% unless they are eligible for zero rating or exemption. when is vat on the parking charged? while vat on car parking does have its drawbacks, it’s important to understand that vat is a tax that contributes to government revenue and helps fund.. Is There Vat On Parking Charges Uk.

From www.tide.co

A guide to domestic VAT reverse charges Tide Business Is There Vat On Parking Charges Uk Later the court clarified the rules as follows: if a business charges for parking, whether it’s a car park, garage, or any other type of parking facility, they may be required to charge vat on top of the parking. Vat of parking fines was unclear till 2013. Where there is no fee for parking in a private park, there. Is There Vat On Parking Charges Uk.

From freedominnumbers.co.uk

VAT Reverse Charge for Construction All You Need to Know Is There Vat On Parking Charges Uk while vat on car parking does have its drawbacks, it’s important to understand that vat is a tax that contributes to government revenue and helps fund. there is vat on some parking. The standard rate of vat increased to 20% on 4 january 2011. Later the court clarified the rules as follows: the standard vat rate is. Is There Vat On Parking Charges Uk.

From www.tide.co

A guide to domestic VAT reverse charges Tide Business Is There Vat On Parking Charges Uk Where there is no fee for parking in a private park, there is no supply for vat purposes. the standard vat rate is 20% vat rates for goods and services. Later the court clarified the rules as follows: The standard rate of vat increased to 20% on 4 january 2011. when is vat on the parking charged? . Is There Vat On Parking Charges Uk.

From www.alamy.com

Parking charges displayed on a sign in a car park operated by Is There Vat On Parking Charges Uk The standard rate of vat increased to 20% on 4 january 2011. while vat on car parking does have its drawbacks, it’s important to understand that vat is a tax that contributes to government revenue and helps fund. if a business charges for parking, whether it’s a car park, garage, or any other type of parking facility, they. Is There Vat On Parking Charges Uk.

From accotax.co.uk

Things You Should know About VAT on Parking Accotax Is There Vat On Parking Charges Uk if the park is public, there will be no vat on any parking fee. The standard rate of vat increased to 20% on 4 january 2011. while vat on car parking does have its drawbacks, it’s important to understand that vat is a tax that contributes to government revenue and helps fund. the standard vat rate is. Is There Vat On Parking Charges Uk.

From www.cambridge-news.co.uk

Parking and road charges could be back on the cards in Cambridgeshire Is There Vat On Parking Charges Uk the standard vat rate is 20% vat rates for goods and services. The standard rate of vat increased to 20% on 4 january 2011. Where there is no fee for parking in a private park, there is no supply for vat purposes. Vat of parking fines was unclear till 2013. while vat on car parking does have its. Is There Vat On Parking Charges Uk.

From calculatethevat.com

Is There VAT on Parking Fees and Fines? Off Street Parking Is There Vat On Parking Charges Uk excess charges for parking are generally subject to vat at the standard rate of 20% unless they are eligible for zero rating or exemption. Where there is no fee for parking in a private park, there is no supply for vat purposes. when is vat on the parking charged? the standard vat rate is 20% vat rates. Is There Vat On Parking Charges Uk.

From www.tide.co

A guide to domestic VAT reverse charges Tide Business Is There Vat On Parking Charges Uk Later the court clarified the rules as follows: when is vat on the parking charged? The standard rate of vat increased to 20% on 4 january 2011. while vat on car parking does have its drawbacks, it’s important to understand that vat is a tax that contributes to government revenue and helps fund. excess charges for parking. Is There Vat On Parking Charges Uk.